Travel Insurance Options for Luxury Villa Stays: What You Need to Know

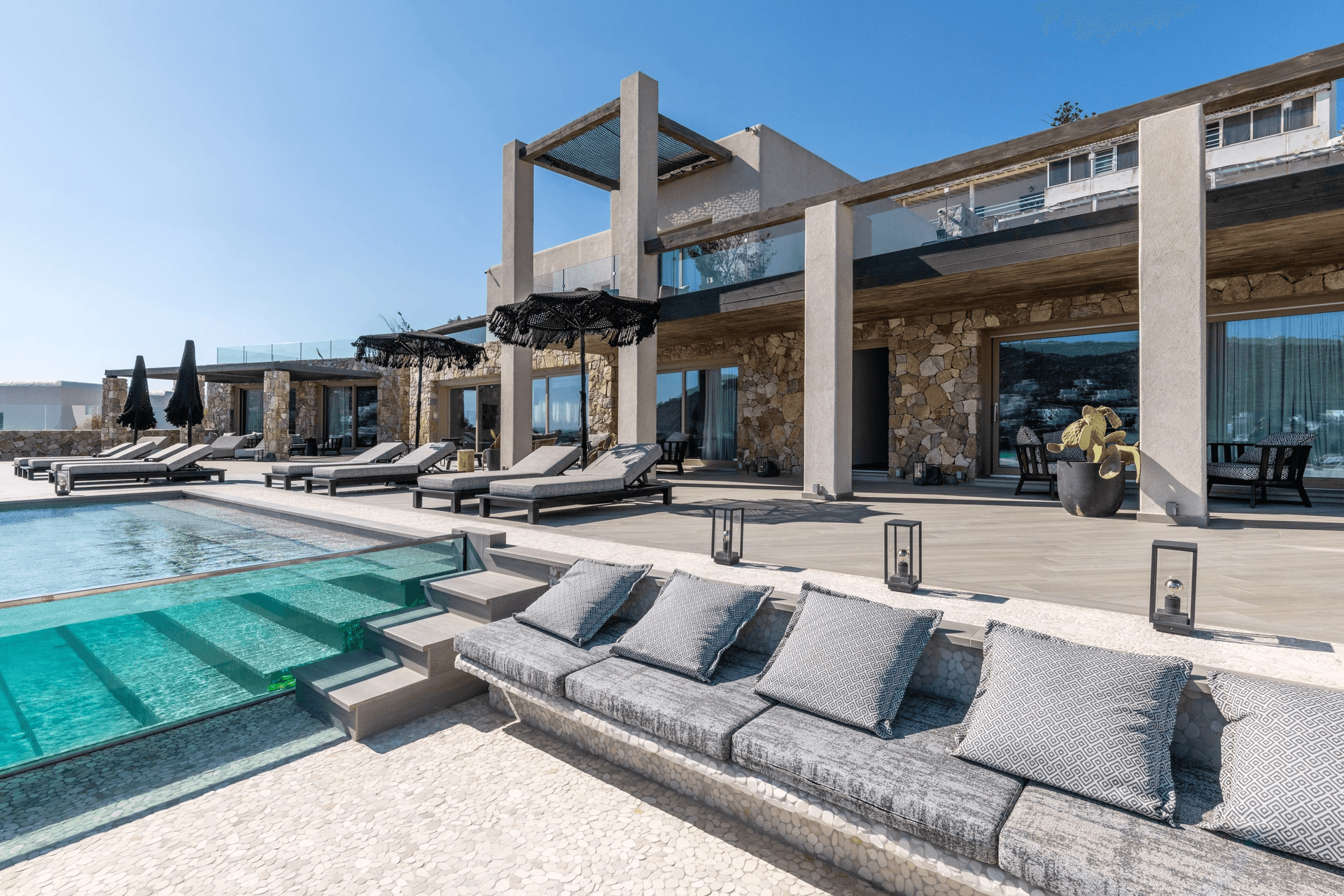

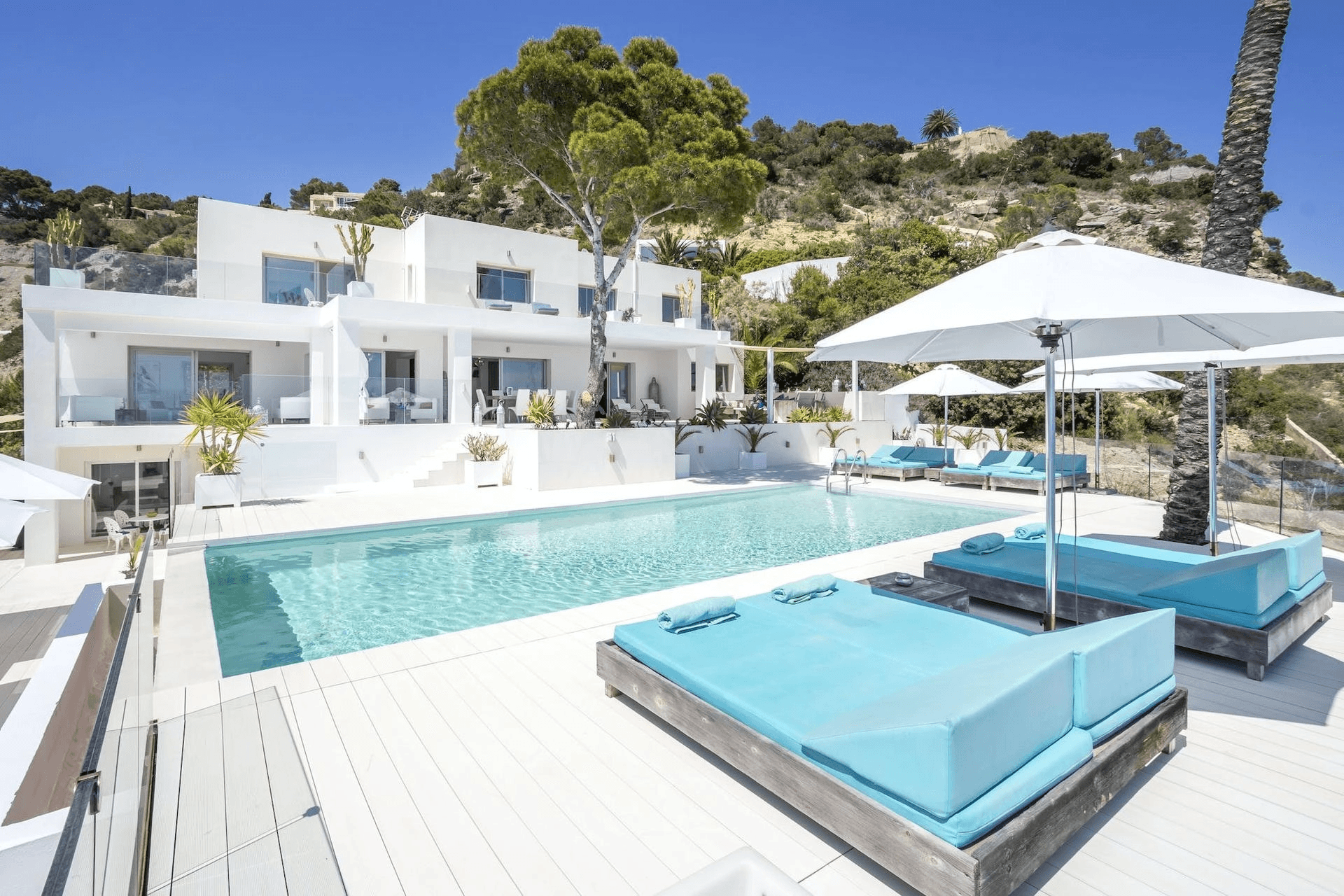

Staying in a luxury villa often means higher costs, bespoke amenities, and unique risks that standard travel insurance may not cover.

Because villas frequently require substantial security deposits and offer amenities like private chefs, heated pools, and personal concierge services, it’s essential to choose a policy designed for high-end accommodation. Below, we’ll explore the most crucial insurance coverages for luxury villa stays, explain why they matter, and help you choose a plan that keeps your trip—and your investment—fully protected.

Why Specialised Travel Insurance Matters for Villa Stays

High-Value Deposits and Potential Damage

Luxury villas often require security deposits ranging from a few thousand to tens of thousands of euros or dollars. If accidental damage occurs—a broken chandelier or a cracked spa tub—the villa owner may keep part or all of that deposit. A travel insurance policy with a “damage waiver” or “rental property damage” rider reimburses the villa owner directly, so you’re not out-of-pocket for repairs or replacements.

Nonrefundable Advance Payments

Unlike a hotel room, many villa rentals demand a substantial advance payment or deposit that becomes nonrefundable in the event of cancellation. Suppose you must cancel due to a covered reason (illness, family emergency, natural disaster). In that case, trip cancellation coverage ensures you recover at least a significant portion, or in some policies, the full amount of what you prepaid.

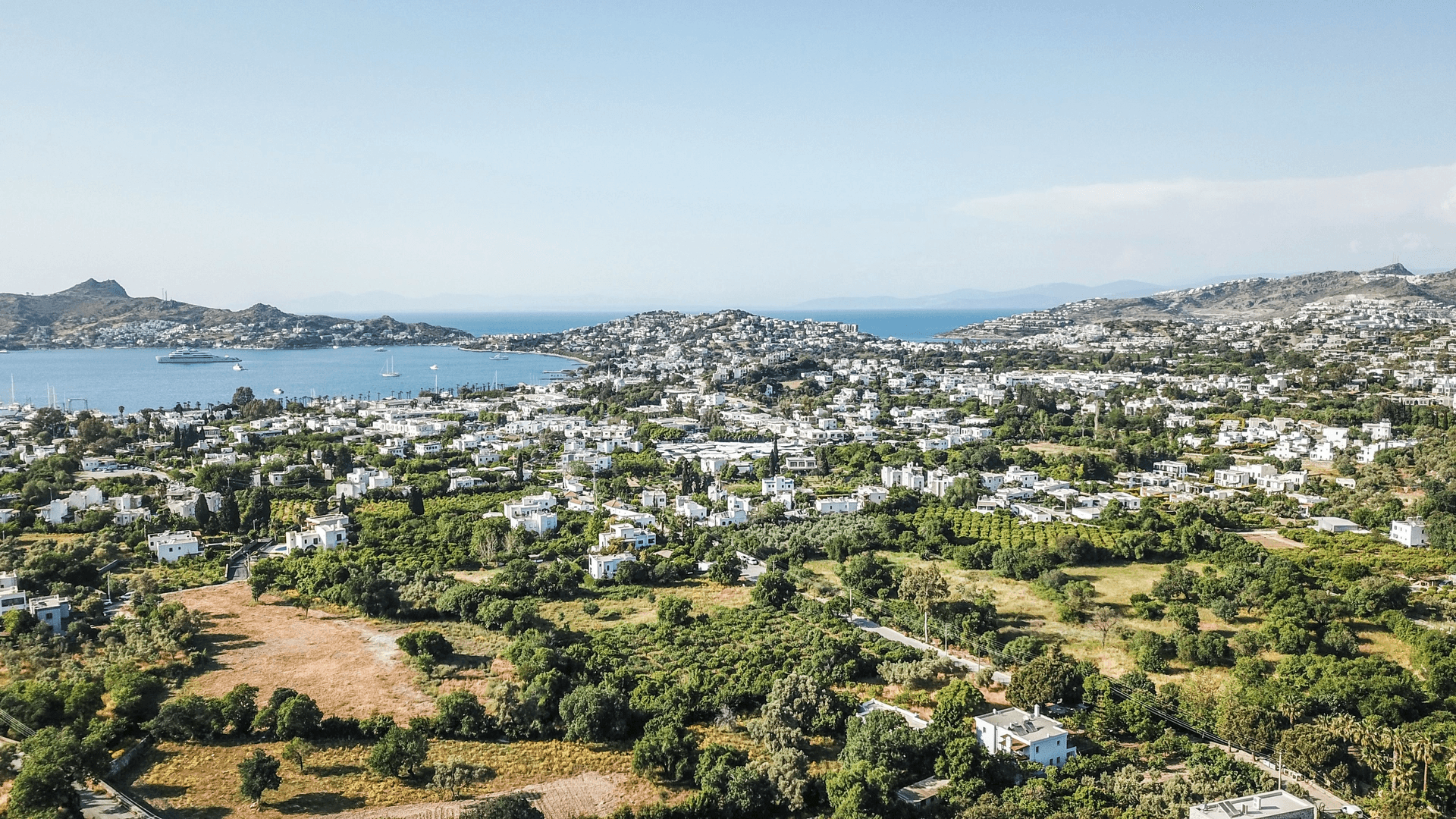

Remote Locations and Medical Evacuation

Luxury villas are often in secluded areas—on private islands, mountainous regions, or countryside retreats. Should you face a medical emergency, local facilities may be limited. Standard travel policies often cap medical evacuation at a low threshold, but a villa-specific plan typically offers higher limits for air or helicopter evacuation, ensuring you can be moved to a well-equipped hospital if needed.

Liability for Personal Injury or Third-Party Damage

Imagine a guest trips on an uneven stone path and suffers an injury, or a rented watersport toy at the villa causes damage to neighboring property. A villa-tailored policy usually includes personal liability coverage (often €1,000,000 or more) to cover legal fees and settlements if you’re found responsible for injuries or property damage.

Core Coverages to Look For in Luxury Travel Insurance

When comparing policies, these coverages should be non-negotiable for luxury villa stays:

Trip Cancellation & Interruption

Reimburses prepaid villa costs if you must cancel for covered reasons (serious illness, death in the family, jury duty, natural disaster at your destination).

Some policies allow “cancel for any reason” (CFAR) add-ons, reimbursing up to 75% of nonrefundable expenses, which is often worthwhile for expensive villa bookings.

Medical Expenses & Evacuation

Look for at least €100,000–€200,000 in medical expense coverage, especially if travelling abroad.

Ensure evacuation and repatriation limits are ample (€50,000–€100,000), since helicopter or fixed-wing air ambulance transfers are costly.

Liability Insurance

A policy covering €1,000,000–€2,000,000 in third-party liability is common.

Confirms you’re protected if a villa feature (e.g., pool steps) contributes to a visitor’s injury, or if you accidentally damage neighbouring property while on vacation.

Security Deposit Protection (Damage Waiver)

Instead of a large deposit on your credit card, you pay a smaller fixed premium (often 1–3% of the total villa cost).

The insurer covers accidental damage up to an agreed limit (commonly €10,000–€20,000).

Baggage & Personal Belongings

While less villa-specific, covering at least €1,500–€2,000 per person ensures protection against theft or loss of valuables (cameras, laptops, jewellery) while travelling to or from the villa.

Travel Delay & Missed Connection

If your flight is delayed and you miss the official check-in window, these benefits can reimburse unexpected expenses, provide extra hotel nights and meals, or arrange alternative transportation to the villa.

Key Differences Between Standard and Villa Insurance Plans

Villa-friendly policies distinguish themselves in four main ways. First, liability limits tend to be significantly higher than those in conventional plans, rising from roughly €500,000 to €1,000,000 or more.

Given the high value of villa fixtures—think antique furniture or custom landscaping—this elevated limit better aligns with potential damage costs.

Second, a dedicated damage waiver feature lets you avoid tying up a hefty security deposit on your credit card. In many cases, the insurer pays the villa owner directly for covered damages up to the agreed limit, so you avoid cash-flow issues and the hassle of deposit holds.

Third, evacuation provisions account for remote locations. Whereas standard policies might limit medical evacuation to road ambulances or cap coverage at €20,000 to €30,000, villa-specific plans budget €50,000 to €100,000 specifically for air transport—often the only way to reach a fully equipped hospital.

Fourth, the coverage of on-site activities tends to be more generous. If you plan to scuba dive, charter a yacht, or rent an ATV through the villa’s concierge, a proper villa plan either includes these activities or offers an optional rider. In contrast, generic plans frequently exclude so-called “high-risk” pastimes, leaving gaps in your protection.

How to Choose the Right Policy

Estimate your total risk by adding nonrefundable villa payments, flights, car rentals, and prepaid activities. For a €15,000 villa deposit, choose a plan that reimburses 100 percent—or at least 75 percent with a “cancel for any reason” option. Next, check medical coverage: if anyone has a preexisting condition, confirm a “stable condition” waiver, and ensure the policy includes helicopter evacuation from remote villas.

Ask your villa owner or agency about required liability limits—often €1 million or €2 million—and upgrade if needed. Clarify how the damage waiver works: does the insurer pay the owner directly or reimburse you after repairs? Since villas often arrange activities like scuba diving or ATV tours, review exclusions carefully. If your base policy excludes those services, add a rider. Finally, read all exclusions—especially for natural disasters and “acts of God”—and consider supplemental coverage if your destination is prone to hurricanes, earthquakes, or political unrest.

Purchasing and Claims: A Step-by-Step Guide

After confirming your villa reservation and deposit amount, collect all trip details—villa cost, confirmation number, check-in/out dates, and traveller names with birthdates. Buy insurance as soon as your booking is final to meet nonrefundable deadlines. Compare quotes labeled “Luxury Villa Insurance” or “Premium Vacation Rental Protection,” and if you’re uncertain about coverage nuances (for example, ATV rentals or a private chef’s equipment), consider a broker’s advice. When your policy arrives, verify names, dates, and coverage limits match the villa owner’s requirements. Save both digital and printed copies of the policy, emergency contacts, and claim forms, and share essential details with your travel companions.

If you must cancel, immediately inform the villa owner (or rental agency) and your insurer, submitting the necessary documents—medical certificates, death notices, or evidence of natural disasters—within 48 to 72 hours, as required. For damage claims, photograph everything before repairs and send the itemised repair estimate to your insurer promptly. In case of a guest injury, call your insurer’s 24/7 hotline at once; they’ll arrange approved medical care or evacuation. Keep all medical bills, prescriptions, and legal paperwork handy throughout the process to support your claim.

Common mistakes and how to avoid them in travel Insurance

Some travellers assume that a generic policy is sufficient, only to discover that their medical evacuation limit is capped at €20,000—far below the real cost of a helicopter transfer from a remote island. Others overlook preexisting-condition clauses, later finding their claims denied when an undisclosed ailment flares up. Another frequent misstep is failing to purchase the damage waiver early; if you wait until after arrival, most insurers will refuse to add that rider.

Similarly, not checking activity exclusions can prove costly: if your plan excludes professional scuba instruction or specific motorised excursions, an accident during a villa-arranged outing could leave you liable for large bills. Finally, don’t assume that because your credit card includes basic travel insurance, you don’t need a villa-specific plan.

Credit card policies often limit medical evacuation and provide no protection for a high-value deposit tied to a villa reservation.

Summary for Travel Insurance options for Luxury Villa Stays

Many travellers assume a standard policy will suffice, only to find their medical evacuation coverage capped at €20,000—far short of a helicopter transfer’s real cost from a remote island. Others miss preexisting-condition clauses and later see their claims denied when an undisclosed health issue flares up abroad.

Waiting until you arrive to purchase a damage waiver is another common error; once you’re on site, most insurers won’t allow that rider. Likewise, failing to review activity exclusions can be expensive: if your plan doesn’t cover professional scuba instruction or certain motorised excursions, an accident during a villa-arranged outing could leave you responsible for hefty bills. And remember, a credit-card policy rarely equals a villa-specific plan—most limit medical evacuation and won’t protect a large deposit for a luxury villa.

If you have any questions or need further guidance, please don’t hesitate to contact us—we’re always here to help!